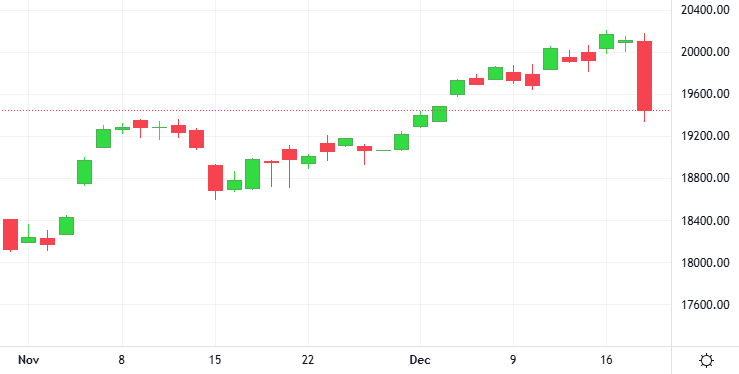

U.S. stocks fell, erasing earlier gains after the Federal Reserve cut interest rates by a quarter of a percentage point and the central bank’s economic projections signaled a slower pace of cuts next year. The Fed cut rates by 25 basis points to the 4.25%-4.50% range.

The U.S. Federal Reserve cut interest rates and signaled it will slow the pace at which borrowing costs fall any further, given a relatively stable unemployment rate and little recent improvement in inflation. U.S. central bankers now project they will make just two quarter-percentage-point rate reductions by the end of 2025.