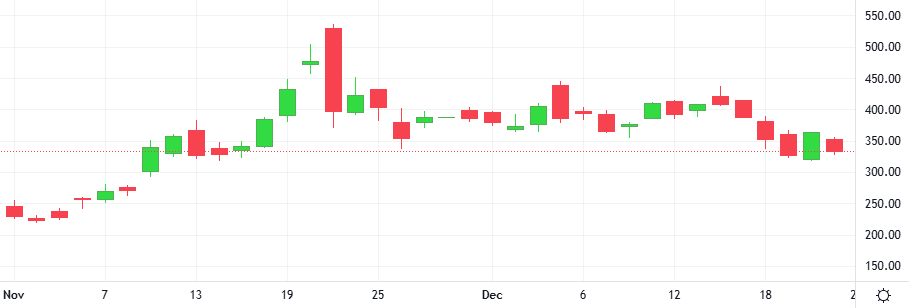

Ether’s price dropped to under $3400, erasing gains from the previous days. This movement followed a 4% decline in Bitcoin and triggered $34 million in liquidations of leveraged ETH longs. Investors grew more risk-averse as signs of weakness emerged in the United States job market.