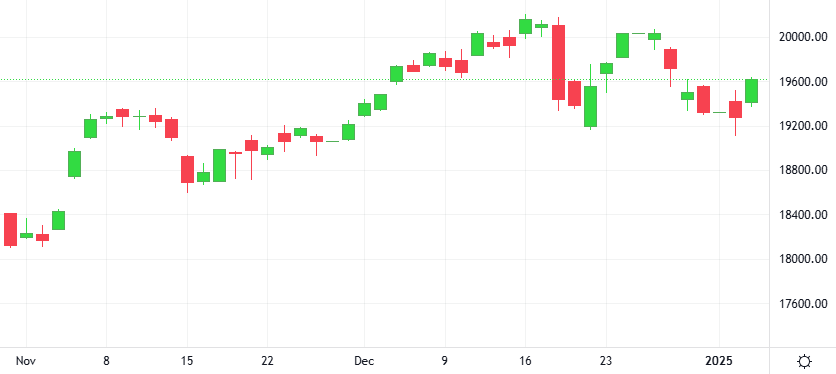

MicroStrategy, the biggest corporate Bitcoin holder, announced a fresh purchase of 1,070 BTC made in the last two days of 2024. The company revealed the purchase on Jan. 6, stating that it spent about $101 million in cash on December 30–31, 2024.

MicroStrategy, the biggest corporate Bitcoin holder, announced a fresh purchase of 1,070 BTC made in the last two days of 2024. The company revealed the purchase on Jan. 6, stating that it spent about $101 million in cash on December 30–31, 2024.

Dogecoin has jumped 21% over the past week, outperforming other major memecoins. Shiba Inu, Pepe and Bonk were up 7%, 10% and 14%, respectively. The rally follows renewed interest from whales.

U.S. stocks rebounded as investors neared the end of a holiday-shortened week that also rang in a new year, which brought with it expectations of additional Federal Reserve rate cuts and looser regulatory policies from the incoming administration.

Taiwan’s Foxconn, the world’s largest contract electronics maker, beat expectations to post its highest-ever revenue for the fourth quarter on continued strong demand for artificial intelligence servers. Revenue for Apple’s biggest iPhone assembler jumped 15.2% to $64.72 billion.

Wall Street see-sawed amid choppy trading, reversing earlier gains as investors embarked on the new year facing the cross-currents of solid labor market data, a rising dollar and tumbling Tesla shares.

Shares of Tesla plummeted 3.3% in the last session. According to the CCI, we are in an oversold market.

Support: 351.38 | Resistance: 409.65

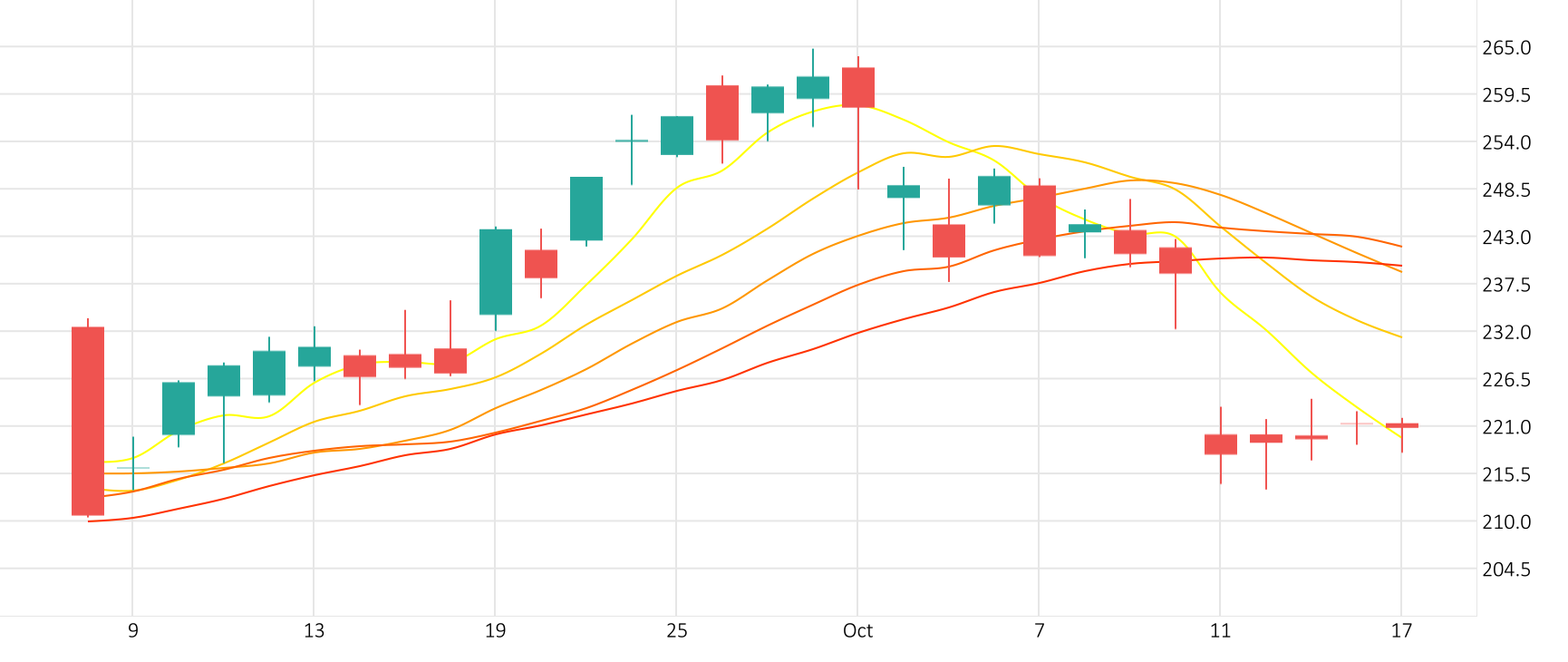

Gold hit a more than two-week high, fuelled by safe-haven buying, while the market took out positions ahead of the Federal Reserve’s rate outlook and President-elect Donald Trump’s looming trade tariffs. Spot gold rose 1.3%.

The Gold-Dollar pair skyrocketed 1.1% in the last session. The MACD is giving a positive signal.

XAU/USD skyrocketed 1.1% in the last session.

The MACD is currently in the positive zone.

Support: 2594.6 | Resistance: 2707.4