Oil prices rose about 2% as investors returned for the first trading day of the new year with an optimistic eye on China’s economy and fuel demand after a pledge by President Xi Jinping to promote growth.

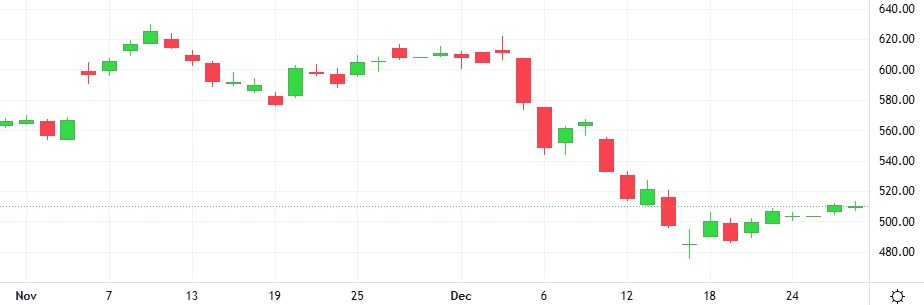

The Oil-Dollar pair skyrocketed in the last session. According to the CCI, we are in an overbought market.

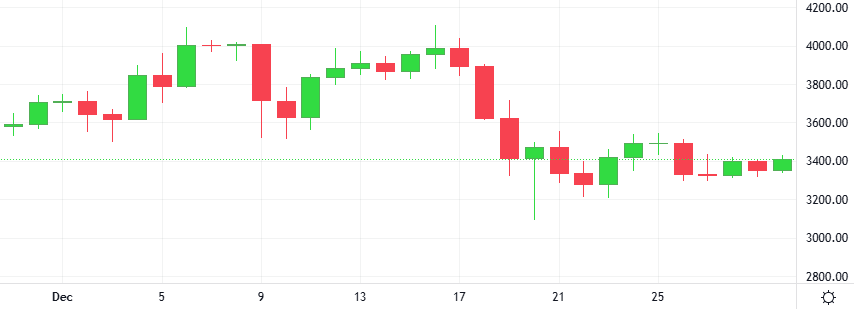

Support: 69.939 | Resistance: 75.519