Bitcoin recorded a 129% year-to-date gain, primarily driven by the outcome of the 2024 United States Presidential election and the April 2024 halving event. Bitcoin also experienced a 37% gain in November 2024.

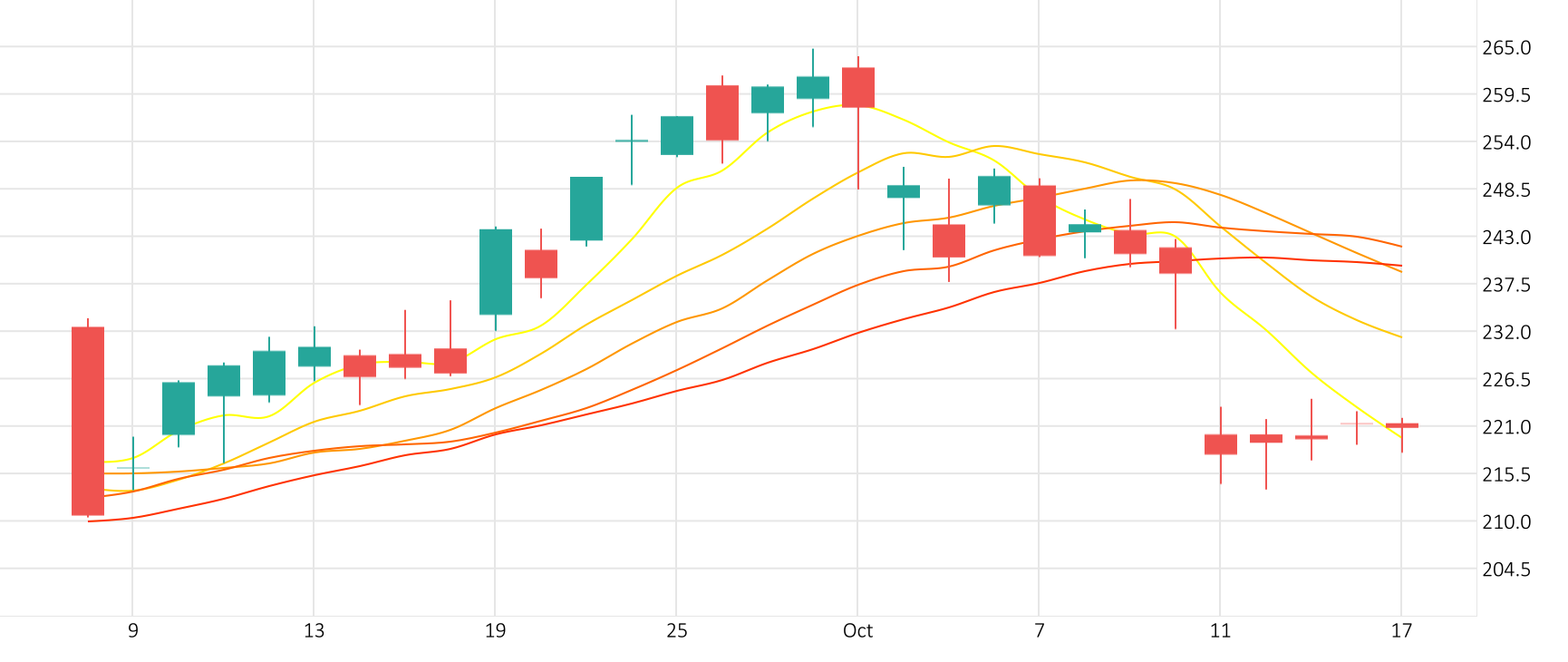

The Bitcoin rose 0.8% against the Dollar in the last trading session. According to the Williams indicator, we are in an overbought market.

Support: 94392 | Resistance: 99738