$100 million investment proposal from Apple to build an accessory and component plant in Indonesia was not enough to allow the sale of the latest iPhone. Indonesia banned sales of iPhone 16 after it failed to meet requirements that smartphones sold domestically should comprise at least 40% locally-made parts.

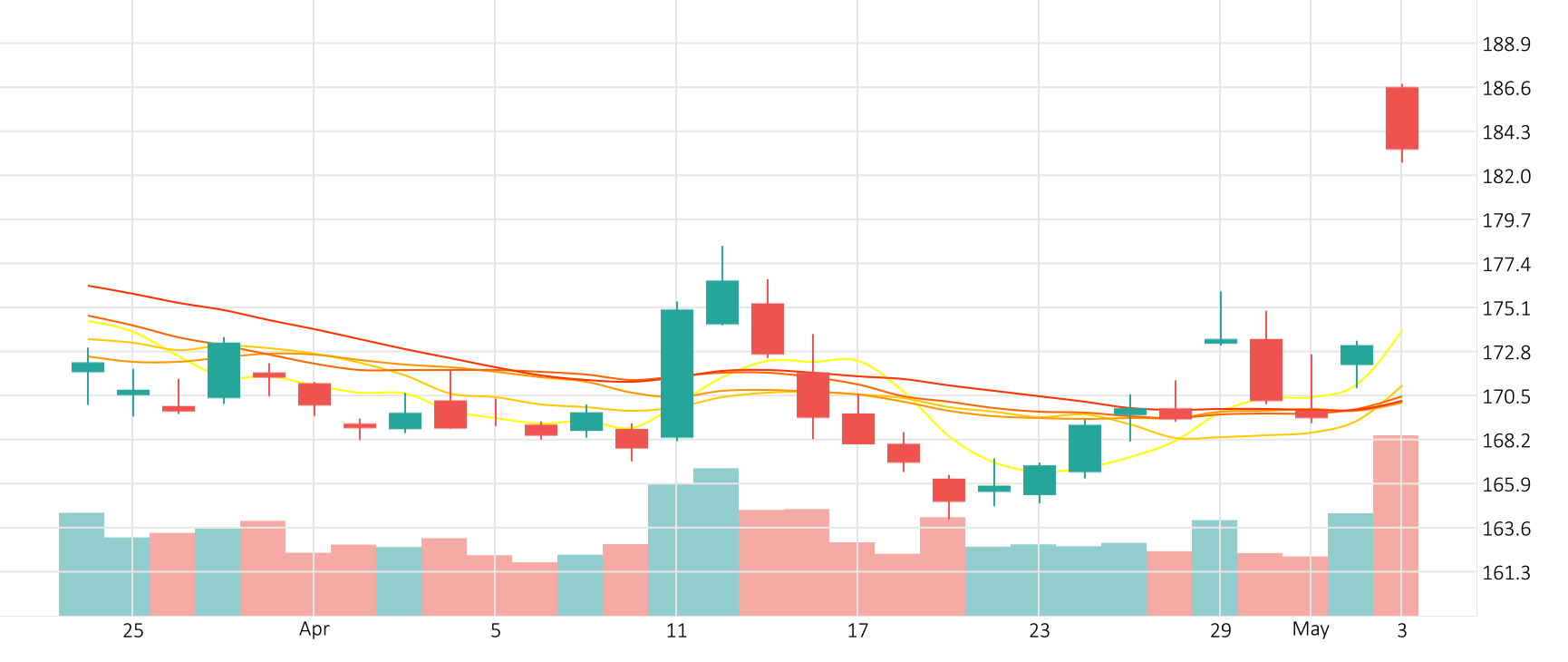

The last session saw Apple shares fall 0.4%. The Ultimate Oscillator is giving a positive signal.

Support: 225.46 | Resistance: 235.94