Tesla’s AI Hiring Spree Amid Stock Volatility

By X-blogger - on May 27, 2024

Tesla’s AI Hiring Spree Amid Stock Volatility

Despite a challenging year with Tesla’s stock down over 27% in 2024, there are signs of recovery. By the close of the market on May 24, TSLA had gained over 3% within 24 hours, trading at $178.95.

New AI Opportunities

In the wake of recent mass layoffs, Tesla is aggressively hiring for numerous AI-related positions with salaries up to $360,000 plus benefits. The company has listed around 20 new engineering roles, all based in Palo Alto, California, focusing on self-driving technology and AI infrastructure. These roles are crucial as Tesla pushes forward with its Autopilot technology and other advanced AI projects.

Beyond AI: Vehicle Technicians

Tesla is also recruiting vehicle technicians for a manufacturing development program. The AI job descriptions emphasize building robust AI infrastructure, training networks on large GPU clusters, and implementing large-scale data processing pipelines. To boost its Autopilot subscription service, Tesla offers a 30-day free trial and requires demos for new owners.

Future Innovations and Regulatory Hurdles

Tesla is gearing up to reveal its Cybercab robotaxi, though regulatory challenges persist due to investigations into Autopilot’s involvement in fatal crashes. Additionally, Tesla is collaborating with China’s Baidu to offer Autopilot’s Full Self-Driving (FSD) in China, with plans to gather self-driving data from Chinese drivers and potentially establish a data center in the country.

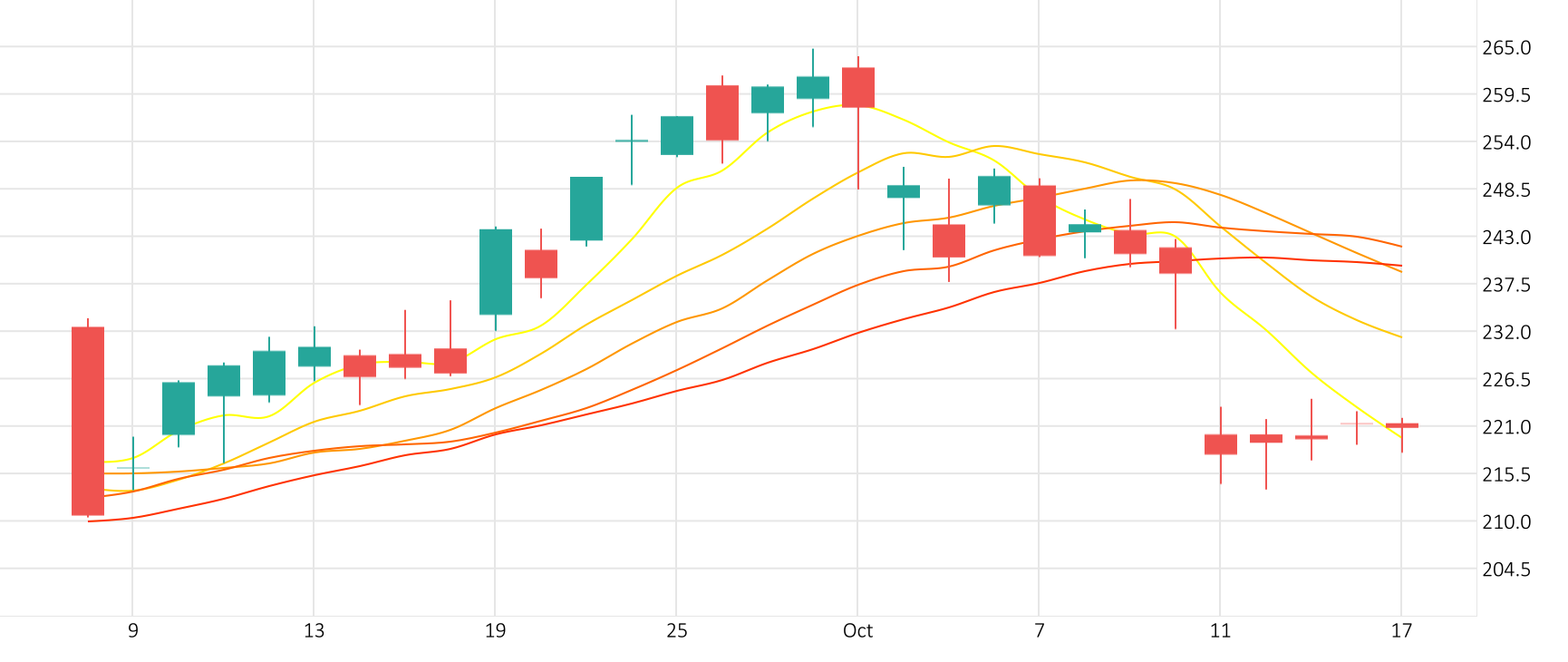

Stock Market Outlook

The stock price of Tesla (NASDAQ: TSLA) shows bullish signs in the short term. According to 53 Wall Street analysts compiled by TradingView, the outlook for Tesla’s stock varies widely.

- Bullish Scenario: Some analysts forecast a high of $310, representing a 72% increase from the current price.

- Moderate Scenario: The consensus average price target is $183, indicating modest growth of about 2%.

- Bearish Scenario: On the low end, forecasts go as low as $85, implying a potential decline of 57%.

Achieving significant production milestones, delivering strong financial results, and making technological advancements could lead to a stock rebound in a bullish scenario. Conversely, facing production issues, increased competition, or broader economic challenges could result in a bearish outcome. A moderate case might see Tesla making steady progress with some headwinds, stabilizing the stock around the current level.

Tesla’s strategic shift towards AI and advanced technology positions, along with its ongoing product innovations, shows the company’s commitment to maintaining its leadership in the electric vehicle and autonomous driving sectors. However, the stock’s future performance will depend on how well Tesla navigates the challenges and opportunities ahead.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification