Trading Online Brokers with Best Dealing Price

By Content-mgr - on April 5, 2016All trading online brokers appear more or less to be the same. But when one trades large volumes, or at volatile times, some brokers are better, way better, than others.

Trading Online Brokers and CFD Liquidity Pool

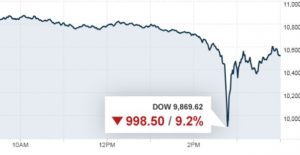

Trading online brokers offer so much today, that it would have been seen as an unfair advantage a decade ago. CFD trading online brokers in particular have improved liquidity so much, that trading efficiency defies belief. The liquidity available in most CFD platforms makes this possible through fast and efficient trade execution. So that a trader always finds a counter-party. The actual technology used is very robust. And in fact, as far as stock trading goes, CFD trading liquidity is better than the underlying stock market. Not only can CFD traders short stocks even when short selling restrictions are imposed at the NYSE, but also it is much less exposed to computer glitches — such as that of 2010, where there was a “flash” crash and the Dow plummeted by some 1000 points in a day. Had you been a CFD stock trader on that day, you would be at normal market risk, while still being able to trade in both directions. And at ultra low dealing costs as always. The forex market is also another area where liquidity pools are important, especially in fast trading of volatile markets. Despite the huge natural liquidity of the forex market, spot brokers still suffer from slippage and re-quotes. CFD forex brokers perform much better on that one too. The only limitation is this superior trading is limited to $100 per pip. Above that level things become to behave like in the spot forex market. But while under $100 per pip, you are at a serious advantage over large spot forex traders. Older traders appreciate CFD liquidity pools exceptionally well. Because they have been through the pre-CFD era, and the dark ages of trading. Moreover, some new forex strategies, not well known yet, are actually made possible through CFDs.

Trading Online Brokers for Advanced Hedgers

Trading online brokers offering CFD contracts are suitable for advanced hedging strategies. The trader in these strategies is able to implement frequent hedging trades at very low cost, and perfect linearity. This kind of trading is becoming popular among traders experimenting with new hybrid strategies. Combining different markets and time frames. Even forex news trading and unorthodox forex signals can be part of such strategies. The only rules required are about hedging risk, either dollar for dollar or asymmetrically. Each approach has different advantages. These CFD brokers provide the liquidity required in each trade. But hedgers care most about linearity. An overlooked factor which is critically important. Even Futures trades who make long term Futures trades (which do not follow markets linearly and fast enough), do all their short term hedging through the highly linear CFD contracts. The net result is significantly smaller losses when things go wrong. And sense of security, since it is okay to be partially wrong, or even very wrong on the timing.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification