Tips For Trading Success on Forex Trading Platforms

By Content-mgr - on August 22, 2016What is Missing in Most Forex Trading Platforms

Forex trading platforms used today are all good, for most tasks a trader may have to do. There are however trades where a simple price chart will not suffice.

Forex Trading Platforms and Competitive Trading

Forex trading platforms and even premium market charting packages are designed around clients’ demands. And even though they cover a wide spectrum of indicators and tools. The wise forex trader may need to resort to yet different types of charts from time to time. Sometimes patterns such as price gaps are visible on some charts, but not on others. And sometimes candlestick analysis may yield different results because different charts show slightly different candle bars. And in extreme cases the trader has to resort to point and figure charts or totally different charts. So as to be able to see beyond market noise and confusion. Forex brokers do their best to meet the demands of their clients on charting tools. And they facilitate online forex trading extremely well. Nonetheless, no amount of prepackaged tools and indicators is ever enough when the markets become really confusing and intimidating. And the wise forex trader has to look even further out for clues on market direction. Forex trading platforms help get the job done, but cannot provide all the tools a trader may possibly need. Even premium charting software fails to go this far.

Forex Trading Platforms and Hedging

The wise forex trader often needs to hedge an open losing trade. This is usually a trade which the trader believes will turn around. And the trading platform provides all the tools necessary, such as contingent orders, to manage trade risk quite well. Forex trading strategies focused on extensive risk control through hedging are clever strategies. The main objective is to expect losing trades, always. And to invoke plan B, specifically for that scenario. The wise forex trader identifies strengths and weaknesses on the charts, and prepares to handle both market directions. Market volatility can be thought of as a third direction. Where no lasting trend will ever develop. And volatility itself is more complex than it appears. Traders who understand volatility and know the underlying daily trends of the markets, make the most money. The forex industry is focused too much on day trading. And yet it is a mistake to be a exclusively a day trader. The forex market has all kinds of participants, and the most influential ones are not exclusive day traders. So it’s a good idea to use forex trading platforms for more than just day trading, the tools are available in them anyway.

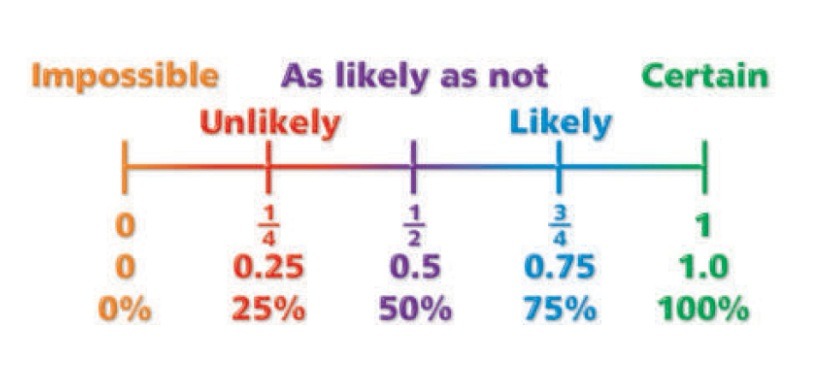

Pay Attention to the Principle of Probability

The basic idea of probability in forex trading is all about imposing time limits on trades. Trading platforms have not yet evolved to this level, but may do so in the future. The idea is that if a trade fails to show profit of at least an amount X or more, at Y number of hours after it has been opened, then the trade will be closed. This timing has to be adjusted around the probability that a trade which takes too long to become profitable. It naturally starts to become very likely that it will turn into a loser. And it is a concept that many floor traders and veteran forex traders have used over the years. And it does work, because it helps traders avoid large losers while still being at the break-even point.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification