How to Use Forex Trading Signals

By Content-mgr - on March 20, 2016In order to use forex trading signals efficiently, traders should adjust more to reality lessen their emotional behavior. Such as confirmation bias habits.

Why Many Forex Trading Signals Fail

Forex trading signals tend to fail, very often in some strategies. And it happens because the criteria are not very clear, there is ambiguity and room for confirmation bias on the part of the trader. Forex trading is promoted by many mentors, why themselves use ambiguous techniques. The mentors however tend to trade at relaxed pace, and make small profits. The new impatient traders are the ones who want to make money fast, and tend to suffer from all kinds of delusions. This is what makes them see profitable trades all over the charts. Forex trading signals are going to have failure rates anyway, even with the best defined trade entry criteria. The impatient trader however, makes things much worse because they are focused on the moment, and usually on one time frame alone. Forex signals can be improved to a satisfactory degree, by being reminded that indicators do not work 100% of the time. Traders can use popular indicators in interrupted rather than continuous mode, and develop trade validating techniques. The basic idea around this is that a single indicator is not reliable enough on its own. But equally so, too many indicators will never agree, and it is actually a minority, not the majority of indicators which will predict the trend right. So it all comes down to finding the right balance, and using more than one indicators but not too many either.

Forex Trading Signals Beyond Just Market Price

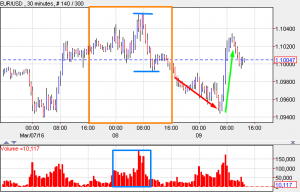

They say the market is always right, but is it really? Market price is strongly influenced by volatility. So much so that it can diverge away from fundamental trends and forces. So much that it becomes very misleading. The market therefore is not always right. The market is right when there is strong agreement between buyers and sellers, and high trading volume occurs. That is why traders pay so much attention to the daily closing price of the stock market, as well as specific time zones in the forex market. Because that’s when most trading volume occurs, and the market is most right at those times. Forex trading signals become much more reliable when these price levels of mutual cooperation between buyers and sellers are identified. Apart from the closing price, these levels are also found around the times where most trading volume took place, and sometimes traders refer to this as the Value Area. In the short term, regardless of the fundamentals, a forex rate will react to the LSS pivots for the day (defined by the previous day’s close). It will also react to the day’s value area (defined by the previous 24 hours volume distribution. The price zone which the rate was trading in, during the highest volume defines the Value Area, and will act as key support and resistance for the next 24 hours. In a nutshell, if a signal calls for a long trade, and price happens to be below the Value Area, then the probabilities are against this trade. In order for the long trade in question to have a better chance of making a profit, market price should be above the Value Area. To this day, no exact formula exists for this Value Area, each trader has their own. But it’s all about figuring out the best practical price zone around the last 24 hours, where most trading volume occurred.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification