On Friday the dollar fell sharply against the yen for the second straight day, raising questions as to whether Japan was intervening, while a global equities index rose as investors turned their focus to U.S. Federal Reserve interest-rate cuts.

On Friday the dollar fell sharply against the yen for the second straight day, raising questions as to whether Japan was intervening, while a global equities index rose as investors turned their focus to U.S. Federal Reserve interest-rate cuts.

BMW reported the strongest sales among Germany’s top three premium carmakers and was the only brand to significantly boost battery-electric deliveries, as Mercedes-Benz and Porsche struggled with low demand, especially in EV segment.

European shares advanced amid broad-based gains and upbeat corporate updates while investors digested more comments from U.S. Federal Reserve Chair Jerome Powell’s second day of testimony.

The pound held near one-month highs, supported by the belief among investors that U.S. interest rates are set to fall sooner than many had predicted, which dented the dollar.

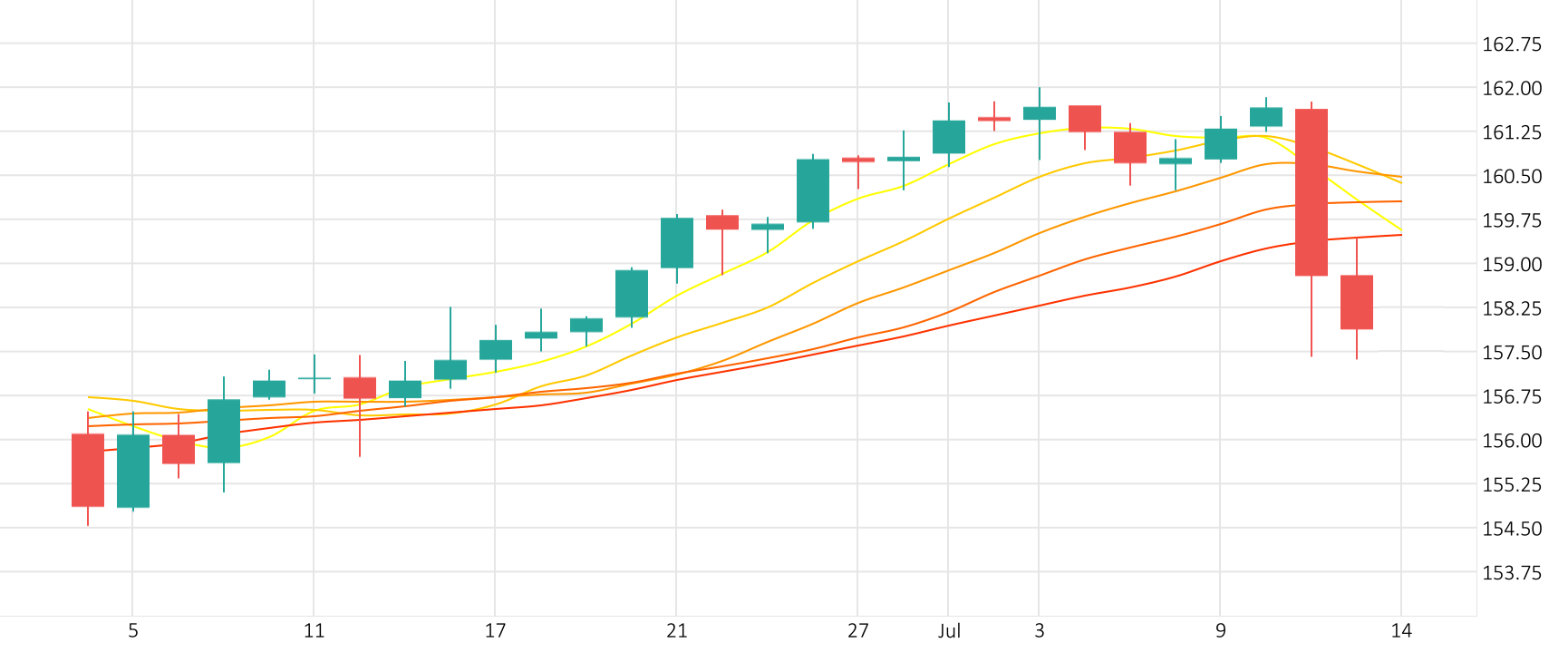

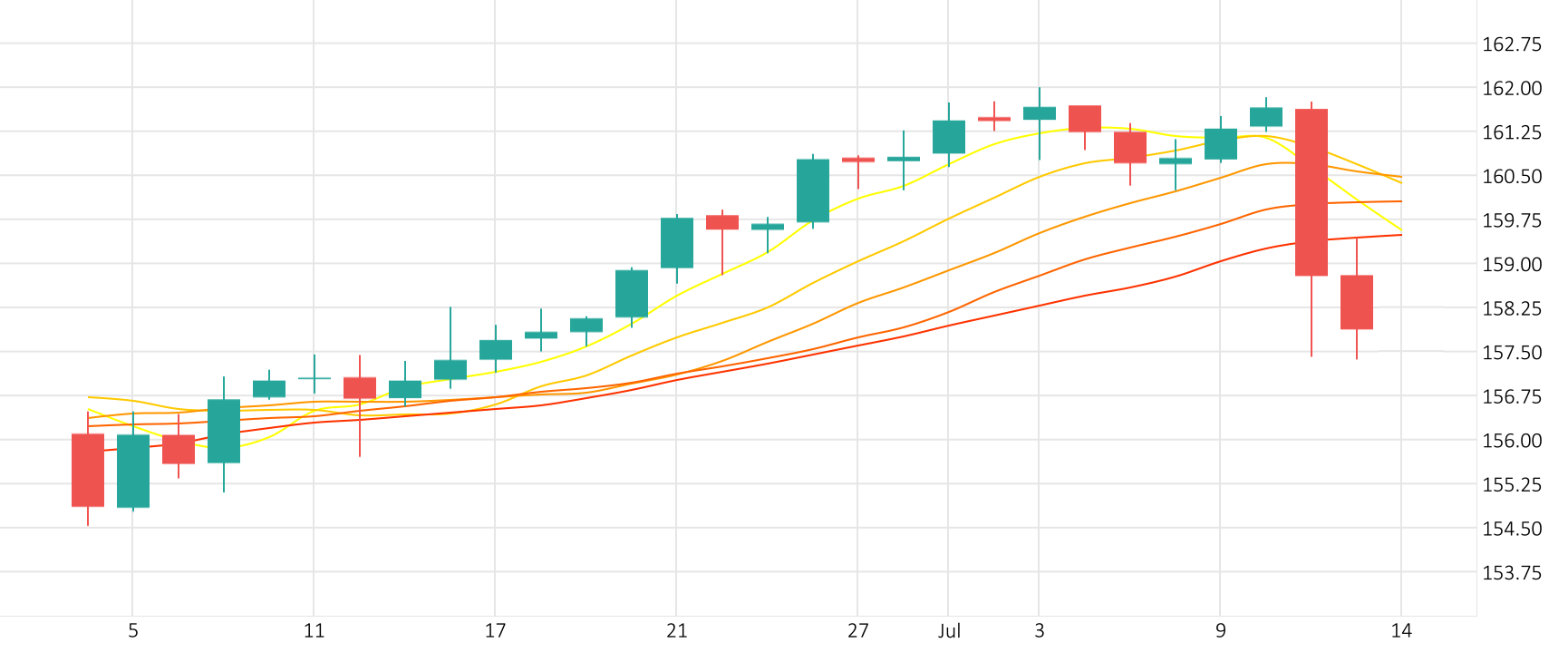

The Pound gained 0.4% against the Dollar in the last session. The Stochastic indicator is giving a positive signal.

GBP/USD rose 0.4% in the last session.

The Stochastic indicator is currently in the positive zone.

Support: 1.2746 | Resistance: 1.2846

In a long-awaited move, Mt. Gox, the infamous Bitcoin exchange that collapsed in 2014, has finally started repaying its creditors. This resolution to one of crypto’s most notorious scandals is not just closing a chapter to one of Bitcoin’s darkest hours but is also actively shaping the asset’s market dynamics in real time.

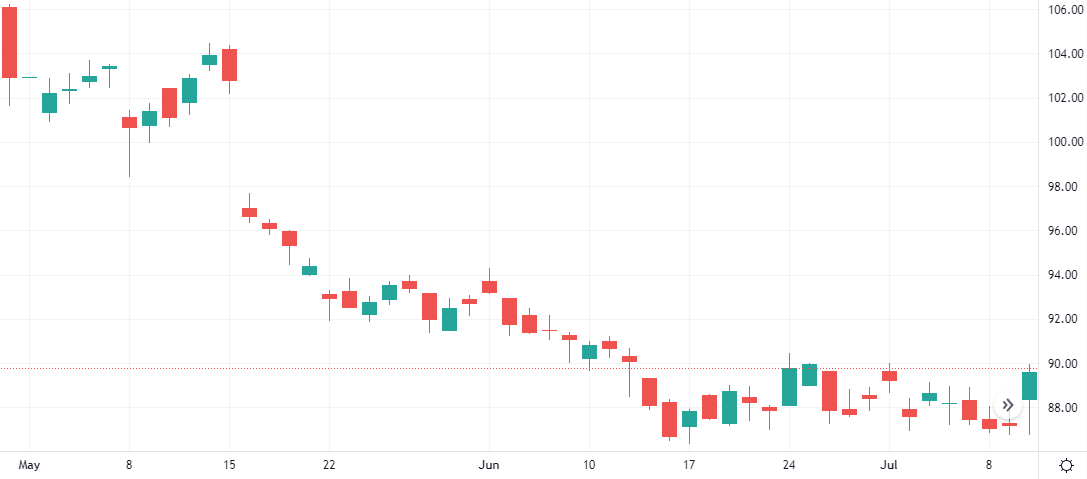

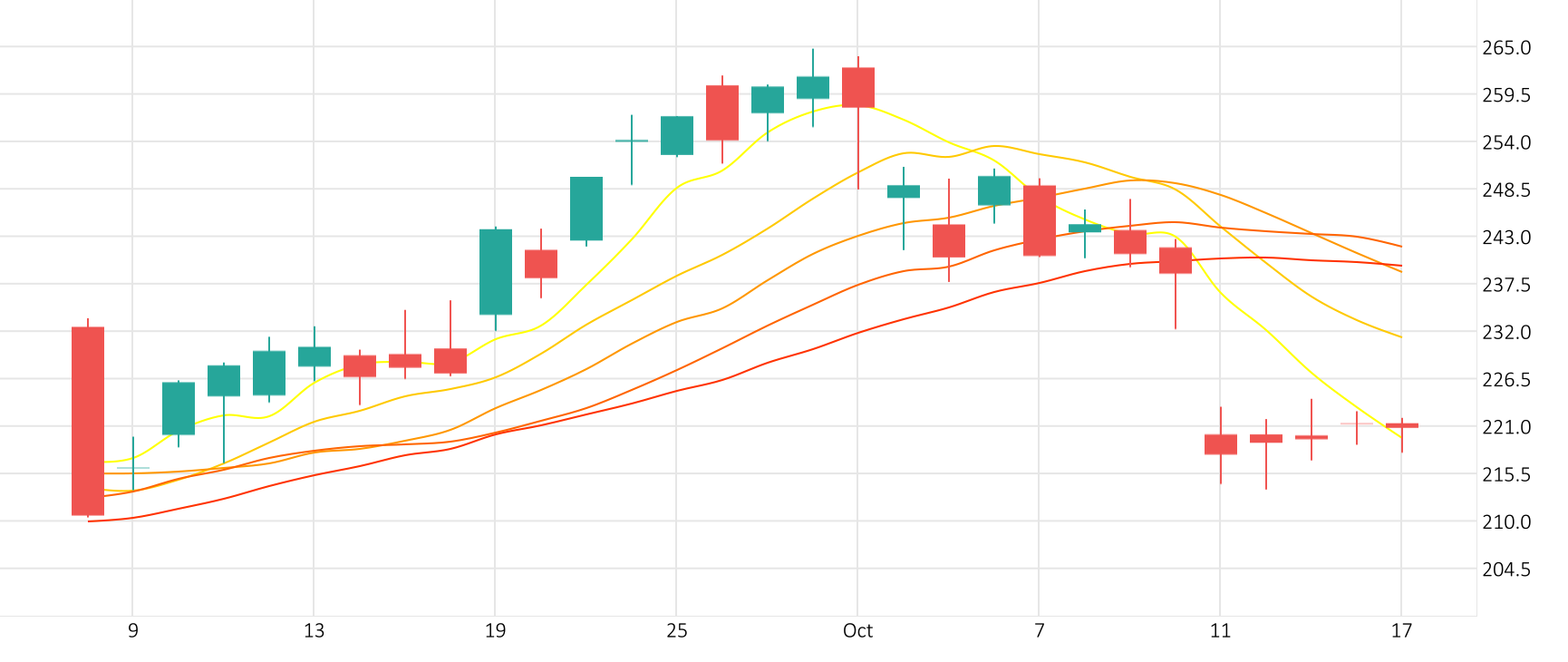

Shares of Tesla skyrocketed 4.5% in the last session. According to the Williams indicator, we are in an overbought market.

Tesla’s stock exploded 4.5% in the last session.

The Williams indicator points to an overbought market.

Support: 237.5605 | Resistance: 267.0189