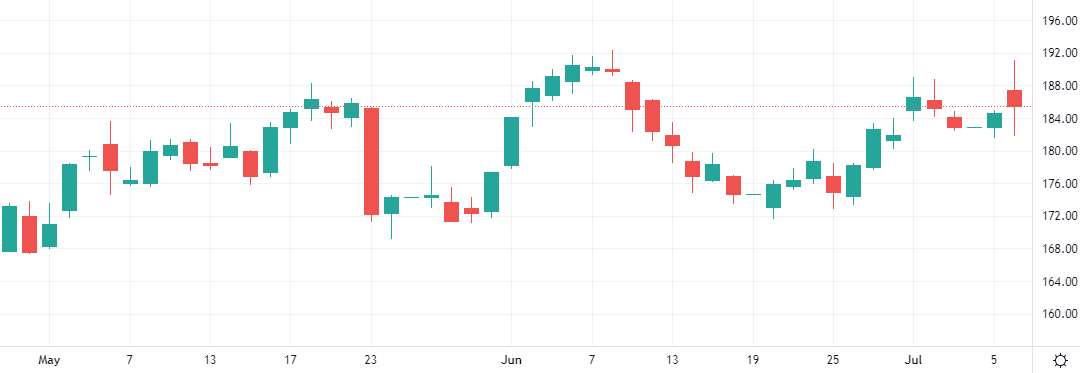

A rally in chip stocks lifted the Nasdaq and S&P 500 to record highs as investors awaited fresh inflation data, commentary from Federal Reserve Chair Jerome Powell and the start of quarterly earnings season. Nvidia jumped 2.5%, while Intel was up 6%

A rally in chip stocks lifted the Nasdaq and S&P 500 to record highs as investors awaited fresh inflation data, commentary from Federal Reserve Chair Jerome Powell and the start of quarterly earnings season. Nvidia jumped 2.5%, while Intel was up 6%

Boeing has agreed to plead guilty to a criminal fraud conspiracy charge and pay a fine of over $243 million to resolve an investigation into two 737 MAX fatal crashes. The plea deal would brand the planemaker a convicted felon in connection with crashes in Indonesia and Ethiopia in 2018 and 2019 that killed 346 people.

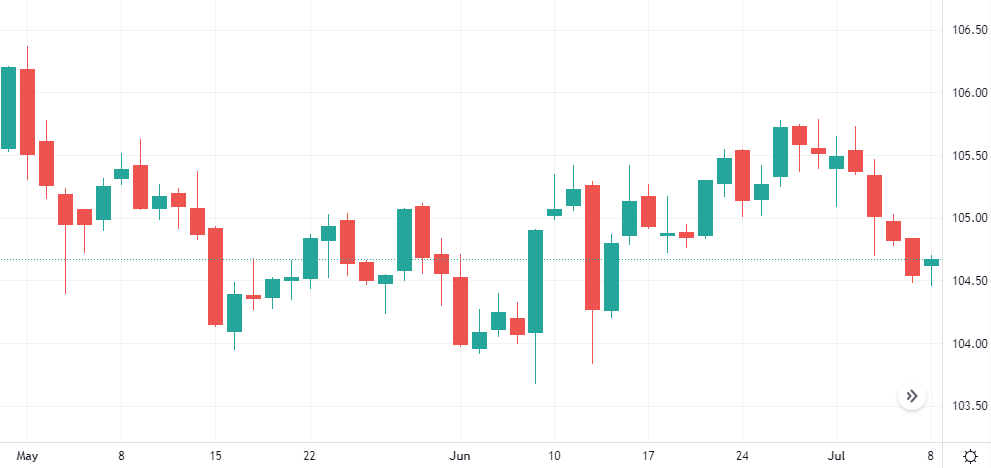

The U.S. dollar index stayed slightly lower after data showed U.S. job growth slowed marginally in June while the unemployment rate rose, underscoring the view the Federal Reserve could begin cutting interest rates in September.

| Gold prices extended gains to their highest level in over a month following key U.S. jobs data that showed the labor market was softening, lifting expectations around a Federal Reserve interest rate cut in September. |

U.S. venture capital funding surged to $55.6 billion in the second quarter, marking the highest quarterly total in two years. The latest figure shows a 47% jump from the $37.8 billion U.S. startups raised in the first quarter, largely driven by significant investments in AI companies, including $6 billion raised by Elon Musk’s xAI.

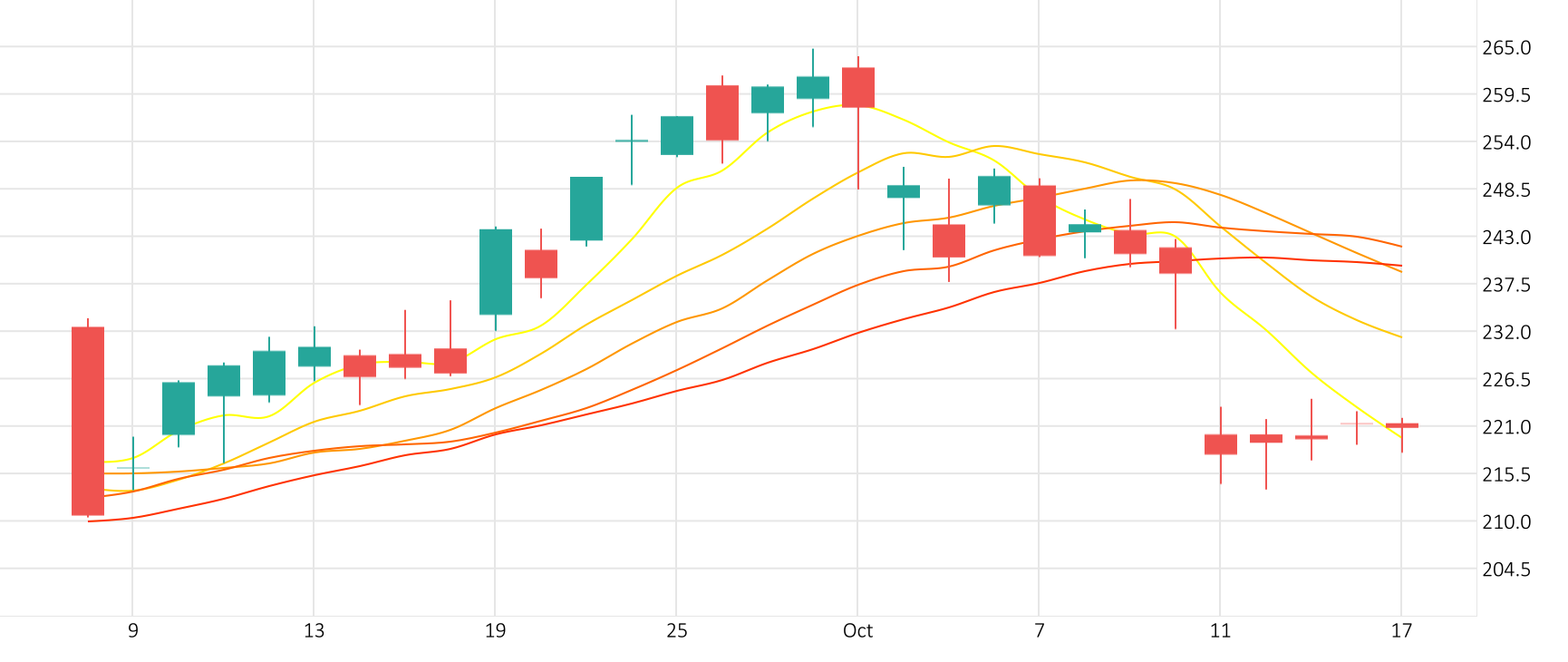

Shares of Tesla skyrocketed 5.0% in the last session. The MACD is giving a positive signal.

Tesla’s stock skyrocketed 5.0% in the last session.

The MACD is currently in the positive zone.

Support: 213.7141 | Resistance: 240.0329

Oil prices gained about 1% after a larger-than-expected decline in U.S. crude stocks, but gains were capped by concerns about rising global inventories in thin trading ahead of the U.S. Independence Day holiday.

The Oil-Dollar pair gained 0.7% in the last session after rising as much as 1.1% during the session. The MACD is giving a positive signal.

WTI/USD gained 0.7% in the last session.

The MACD is currently in positive territory.

Support: 81.971 | Resistance: 85.291