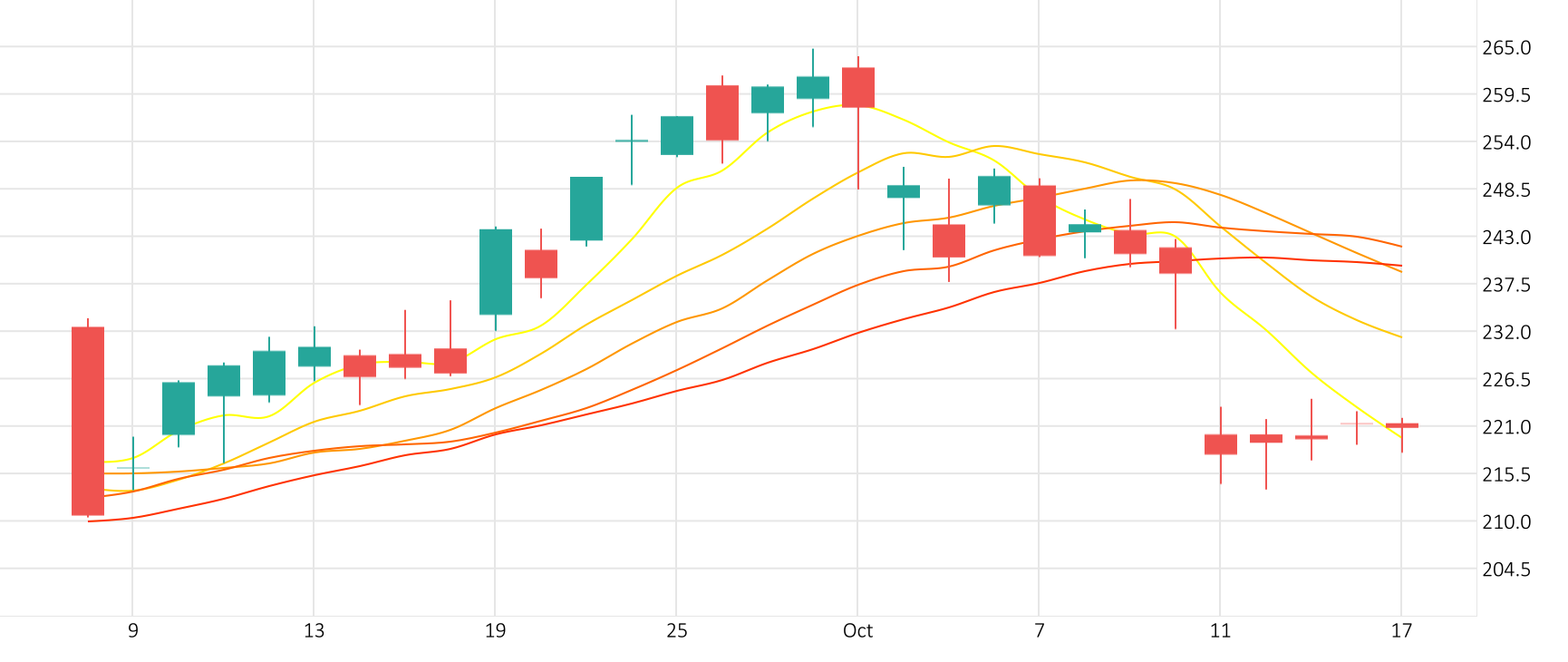

U.S. monthly inflation was unchanged in May as a modest increase in the cost of services was offset by the largest drop in goods prices in six months, drawing the Federal Reserve closer to start cutting interest rates later this year.

Global stock indexes edged lower, reversing early gains, while Treasury yields rose and the U.S. dollar declined as investors absorbed data that showed U.S. monthly inflation was unchanged in May.