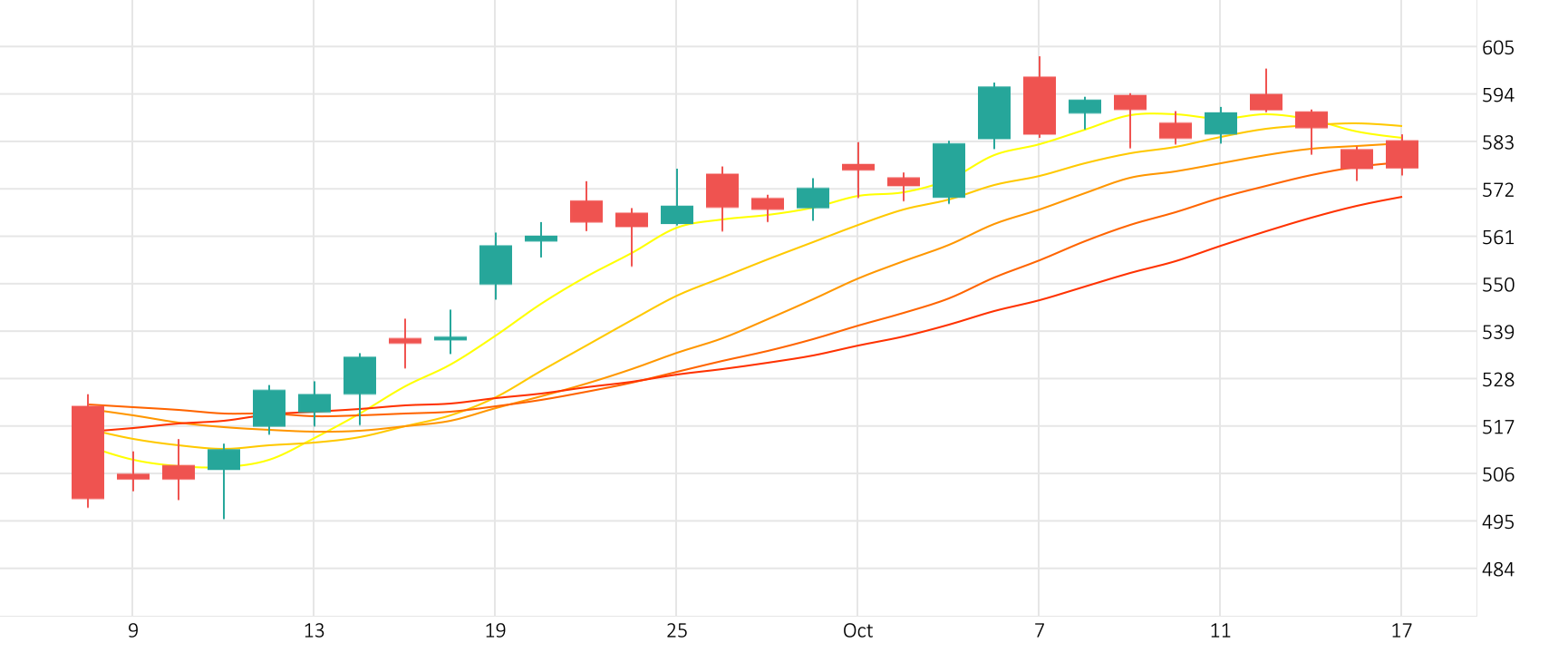

Meta shares rose 2.7% in the last session. The Stochastic-RSI is giving a positive signal.

Meta’s stock rose 2.7% in the last session.

The Stochastic-RSI is giving a positive signal.

Support: 486.926 | Resistance: 513.718

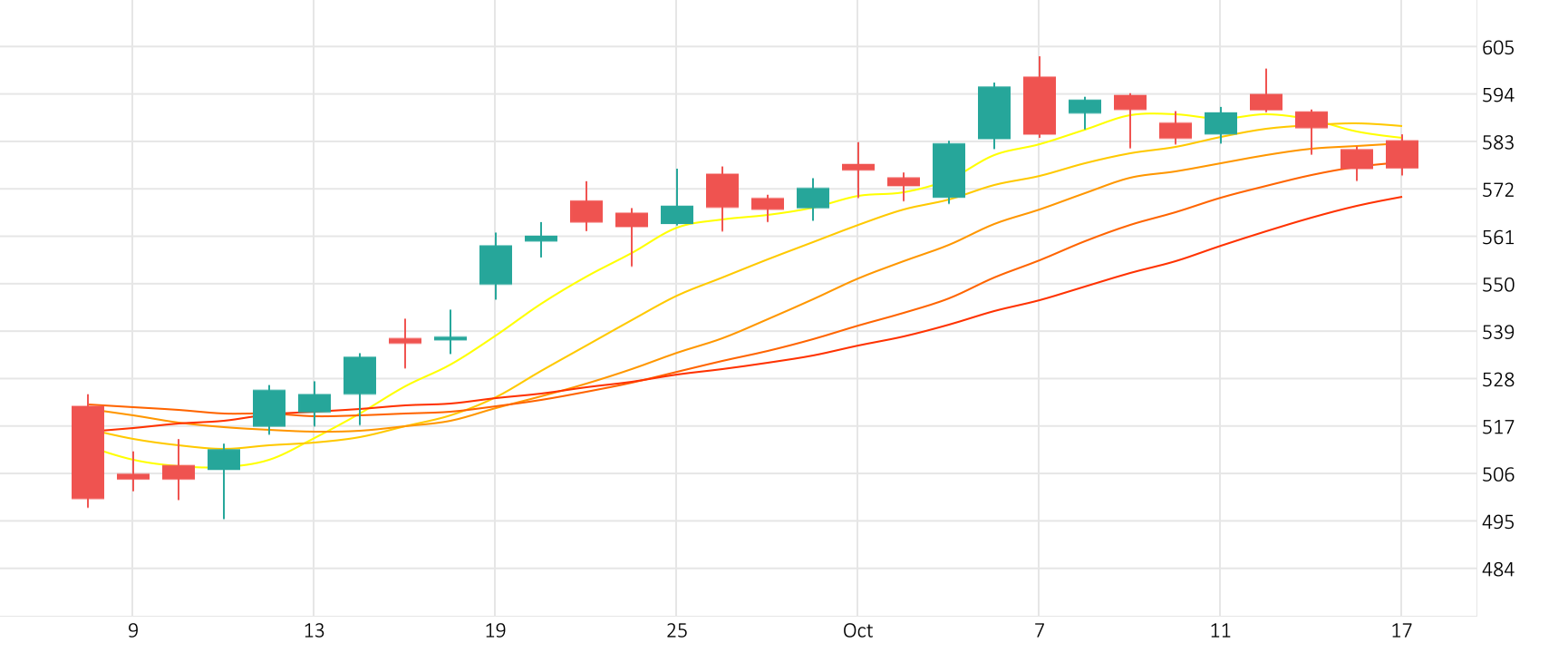

Meta shares rose 2.7% in the last session. The Stochastic-RSI is giving a positive signal.

Meta’s stock rose 2.7% in the last session.

The Stochastic-RSI is giving a positive signal.

Support: 486.926 | Resistance: 513.718

The U.S. dollar rose, bolstered by hawkish comments from Federal Reserve officials as well as data showing a stable housing market in the world’s largest economy, both suggesting that the central bank will not be in a rush to kickstart its rate-cutting cycle.

Gold prices slipped, hurt by an uptick in the dollar and Treasury yields as investors awaited U.S. inflation data due later this week that could provide cues on the timing of interest rate cuts by the Federal Reserve this year.

The Gold-Dollar pair fell 0.4% in the last session. The MACD is giving a positive signal.

The last session saw XAU fall 0.4% against USD.

The MACD is currently in positive territory.

Support: 2310.7927 | Resistance: 2346.0827

The Bitcoin-Dollar pair plummeted 5.8% in the last session. The Stochastic-RSI indicates an oversold market.

BTC/USD plummeted 5.8% in the last session.

The Stochastic-RSI is signalling an oversold market.

Support: 624061 | Resistance: 650601

The Aussie-Dollar pair gained 0.3% in the last session. The Williams indicator is giving a positive signal.

AUD/USD gained 0.3% in the last session.

The Williams indicator is giving a positive signal.

Support: 0.6621 | Resistance: 0.666

The U.S. dollar slipped from an eight-week high against the yen, with traders back on alert for government intervention to support the Japanese currency after it hit just shy of 160, a level that earlier triggered action from the Ministry of Finance to prop it up.

The Dollar-Yen pair made a minor downwards correction in the last session, dropping 0.1%. The ROC is giving a negative signal.

USD/JPY saw a minor dip of 0.1% in the last session.

The ROC is giving a negative signal.

Support: 159.5333 | Resistance: 160.0933