The yen sank to a 38-year low against the U.S. dollar and a record trough versus the euro, as the Japanese unit continued its downward spiral, with market participants on high alert for Japanese intervention to boost the currency.

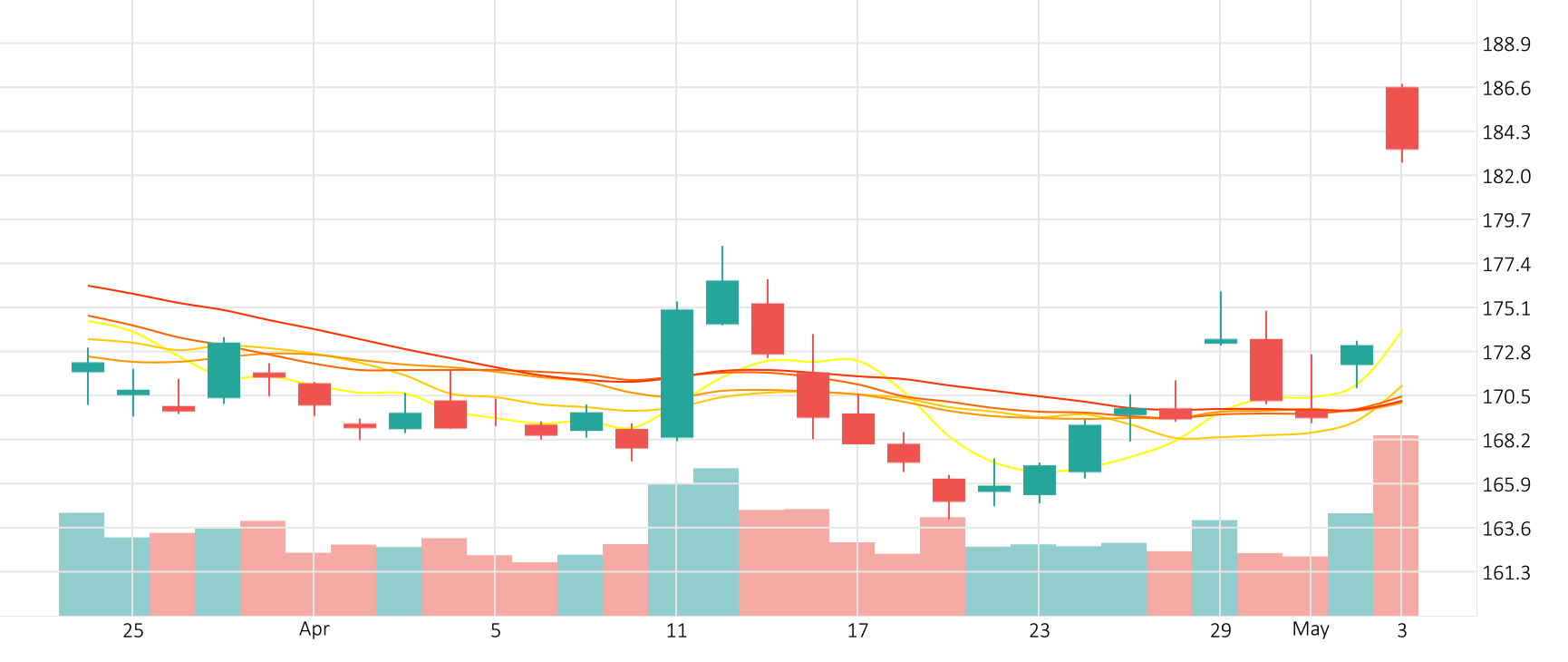

The Dollar-Yen pair traded sideways in the last session. The ROC’s is giving a negative signal.

USD/JPY remained largely unchanged in the last session.

The ROC is currently in the negative zone.

Support: 160.991 | Resistance: 1621