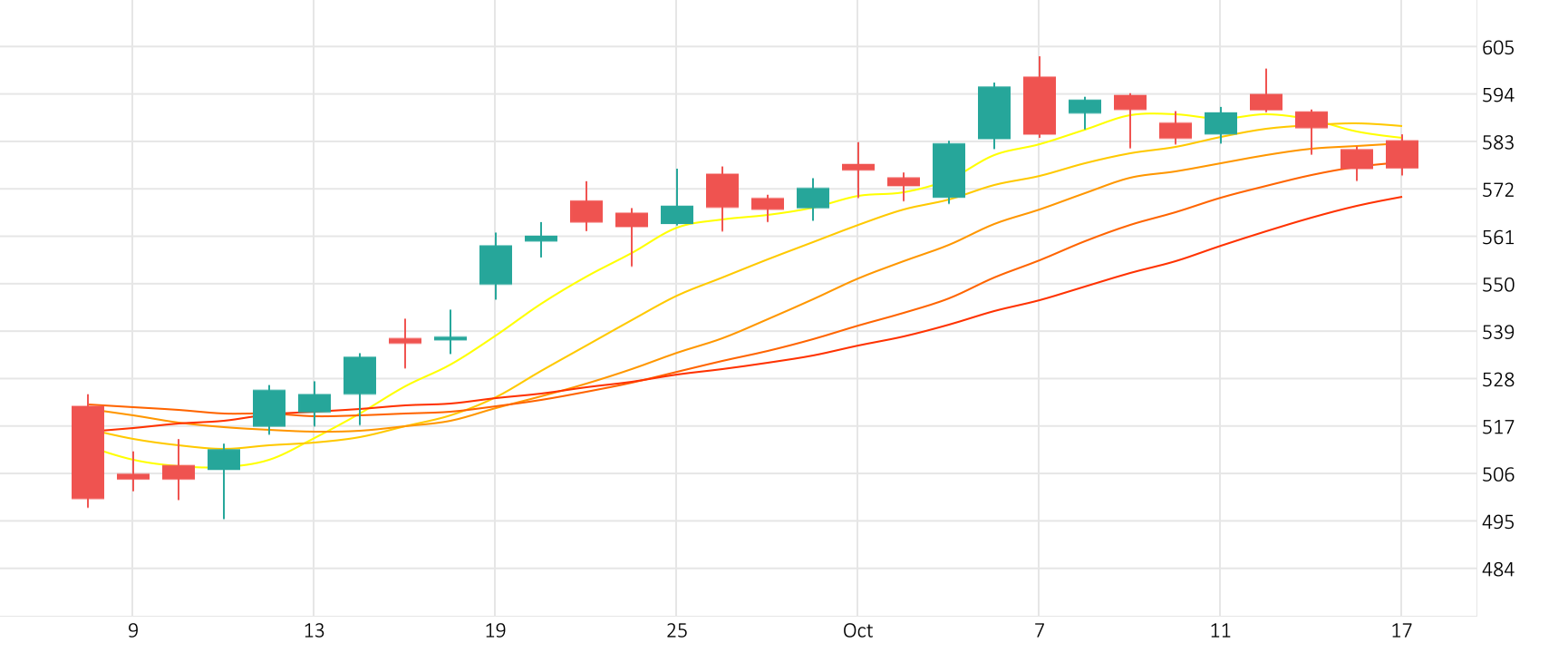

Oil settled higher as ongoing tensions in the Middle East lent support to prices, but news that interest rate cuts could start as late as December capped gains, following the Federal Reserve’s statement concluding its two-day meeting.

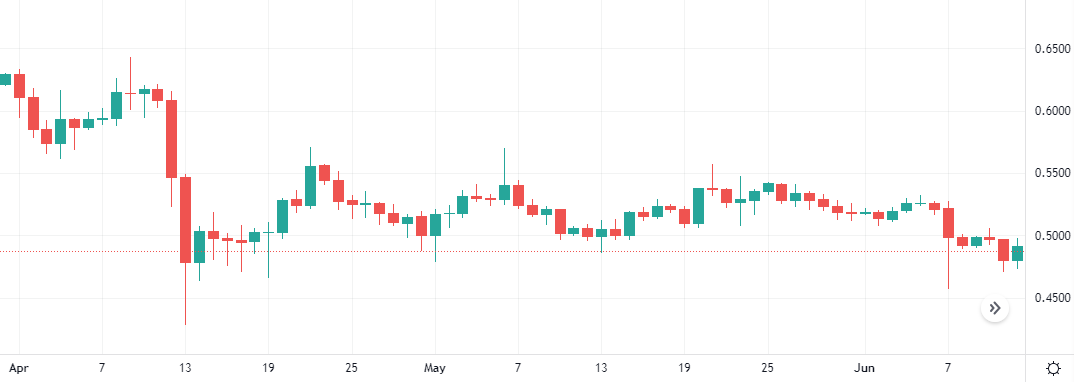

WTI/USD saw a minor rise of 0.2% in the last session.

The Williams indicator is currently in the positive zone.

Support: 76.911 | Resistance: 79.151