Nvidia rallied to record highs, with the artificial intelligence chipmaker’s valuation breaching the $3 trillion mark and overtaking Apple to become the world’s second most valuable company.

Nvidia rallied to record highs, with the artificial intelligence chipmaker’s valuation breaching the $3 trillion mark and overtaking Apple to become the world’s second most valuable company.

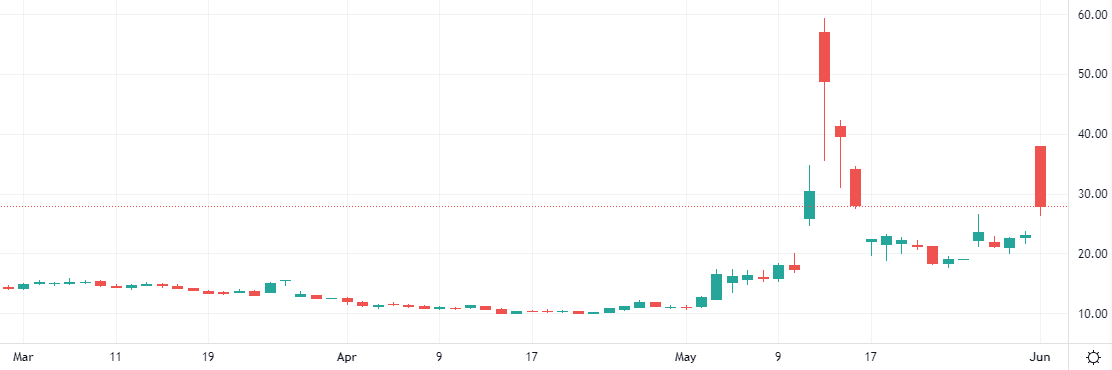

The Silver-Dollar pair exploded 1.4% in the last session. The ROC is giving a positive signal.

XAG/USD exploded 1.4% in the last session.

The ROC is currently in positive territory.

Support: 28.3961 | Resistance: 31.4342

Tesla will likely spend between $3 billion and $4 billion on its purchases of chip company Nvidia’s hardware this year, CEO Elon Musk said. Musk also said that out of the $10 billion in artificial intelligence-related capital expenditure this year, around half would be internal spend.

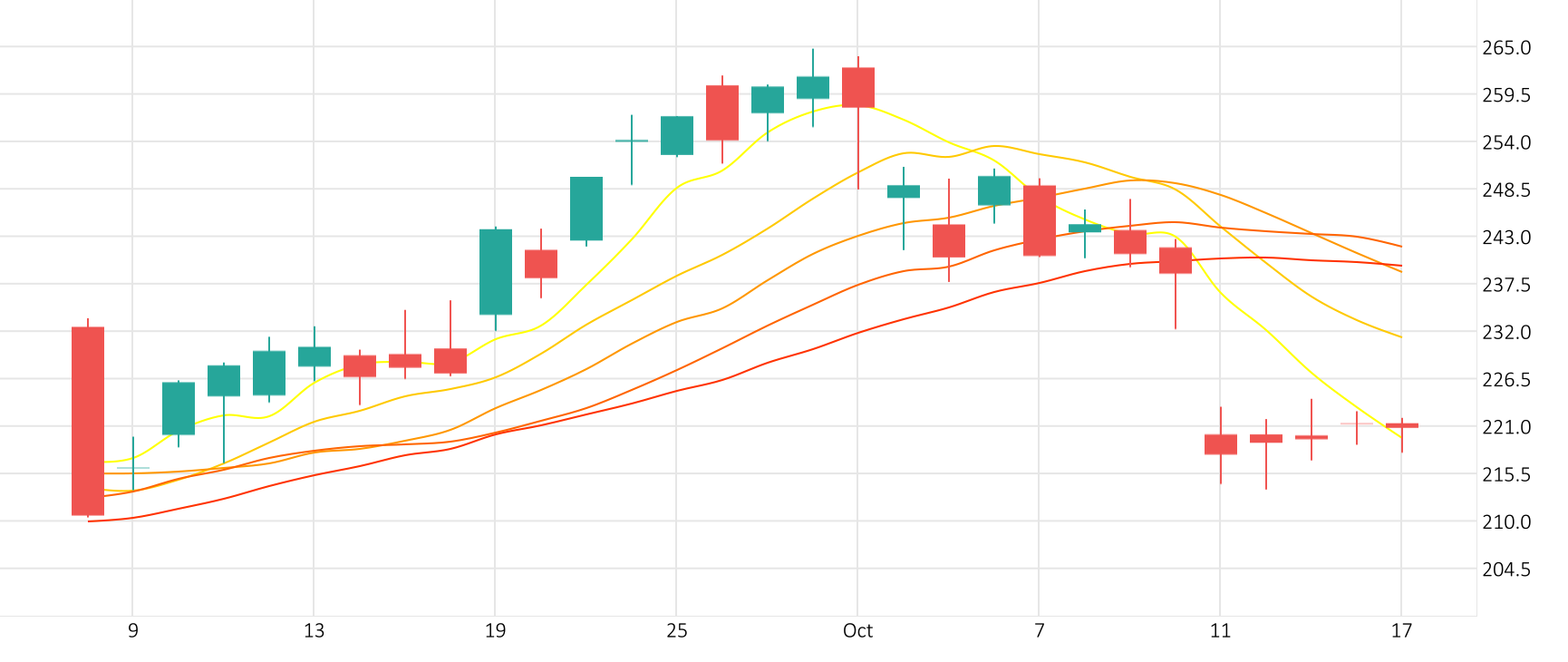

Tesla’s stock price remained largely unchanged in the last session. The CCI is giving a negative signal.

Support: 169.7733 | Resistance: 185.7633

Oil prices fell more than $1 a barrel on scepticism about an OPEC+ decision to boost supply later this year into a global market where demand has already shown signs of weakness.

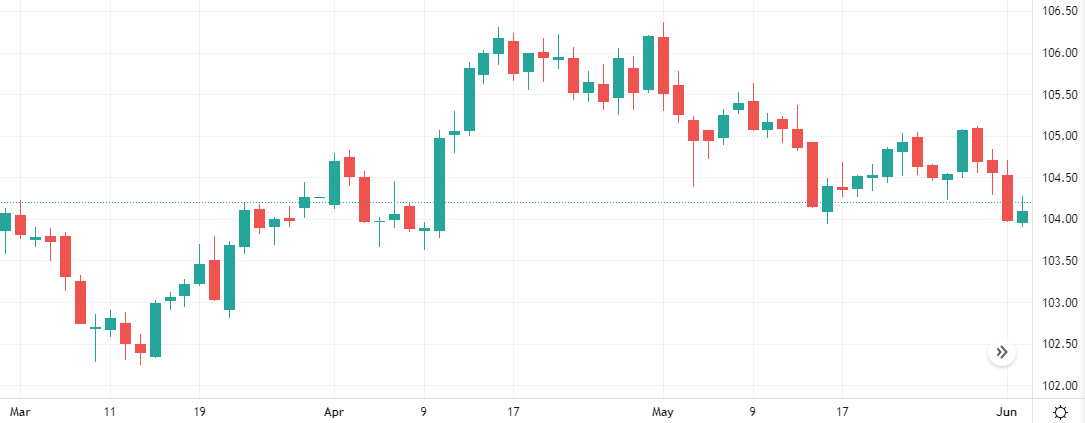

The Oil-Dollar pair plummeted 1.5% in the last session. The CCI indicates an oversold market.

Support: 71.661 | Resistance: 79.061

The U.S. dollar edged higher from its more than two-month lows against the euro, sterling and Swiss franc, as investors consolidated gains in other currencies ahead of a key nonfarm payrolls report later this week.

GameStop shares jumped around 30% on Monday after the stocks influencer known as “Roaring Kitty” returned to Reddit with a post showing a $116 million bet on the embattled videogame retailer.