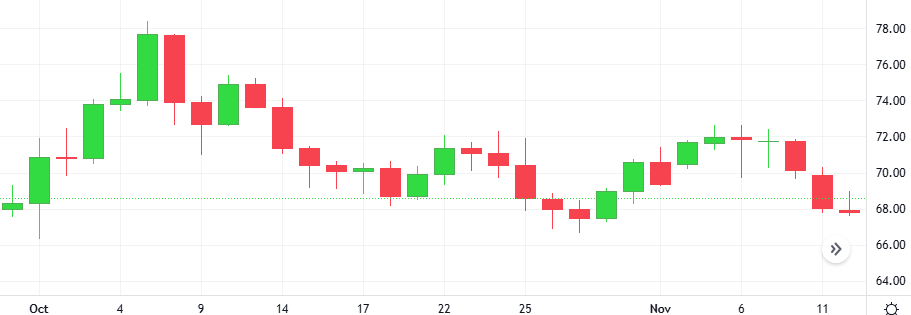

Gold prices extended losses for the fourth straight session, weighed down by a stronger dollar and elevated bond yields on news that October U.S. consumer prices increased as expected.

The Gold fell 0.6% against the Dollar in the last trading session. According to the Stochastic-RSI, we are in an oversold market.

Support: 2525.7 | Resistance: 2648.4