The Silver-Dollar pair fell 2.9% following a 3.2% intra-session dip. According to the CCI, we are in an oversold market.

XAG/USD dove 2.9% in the last session.

The CCI is signalling an oversold market.

Support: 29.051 | Resistance: 32.468

The Silver-Dollar pair fell 2.9% following a 3.2% intra-session dip. According to the CCI, we are in an oversold market.

XAG/USD dove 2.9% in the last session.

The CCI is signalling an oversold market.

Support: 29.051 | Resistance: 32.468

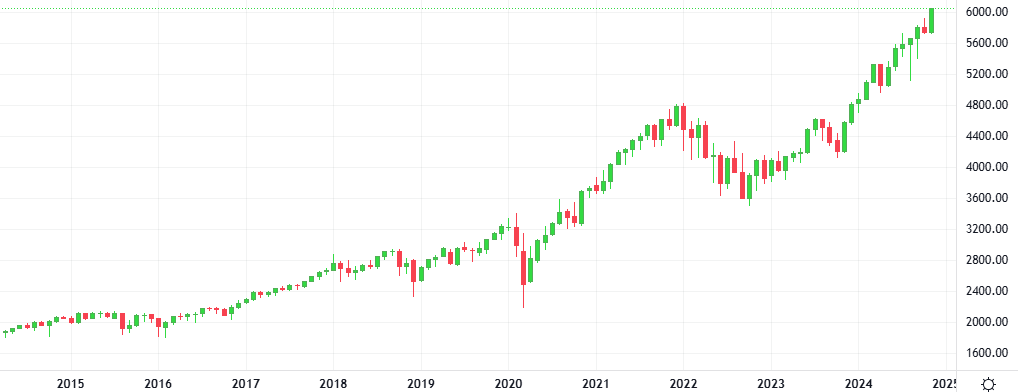

Investors will focus in the coming week on whether inflation trends can help sustain the record-breaking stock rally that has received a boost from Donald Trump’s victory in the U.S. presidential race. The benchmark S&P 500 surged to an all-time high and hit the 6,000 level for the first time.

Gold prices dropped to end last week, logging their steepest weekly decline in over five months, pressured by a stronger dollar and as markets absorbed the implications of Donald Trump’s victory and its potential impact on U.S. interest rate expectations.

The last session saw the Gold fall 0.8% against the Dollar. The MACD is giving a negative signal.

The last session saw XAU fall 0.8% against USD.

Support: 2642.3 | Resistance: 2732.8

Investors will focus in the coming week on whether inflation trends can help sustain the record-breaking stock rally that has received a boost from Donald Trump’s victory in the U.S. presidential race. The benchmark S&P 500 surged to an all-time high and hit the 6,000 level for the first time.

The Bitcoin-Dollar pair exploded 4.6% in the last session. The ROC is giving a positive signal.

BTC/USD exploded 4.6% in the last session.

Support: 73577 | Resistance: 86402

The dollar soared to a four-month high after Republican Donald Trump won the U.S. presidential election, with policies on immigration, tax and trade expected to spur higher U.S. growth and inflation.

The Euro-Dollar pair plummeted 1.6% in the last session. The Stochastic indicator’s is giving a positive signal.

Support: 1.0392 | Resistance: 1.1147

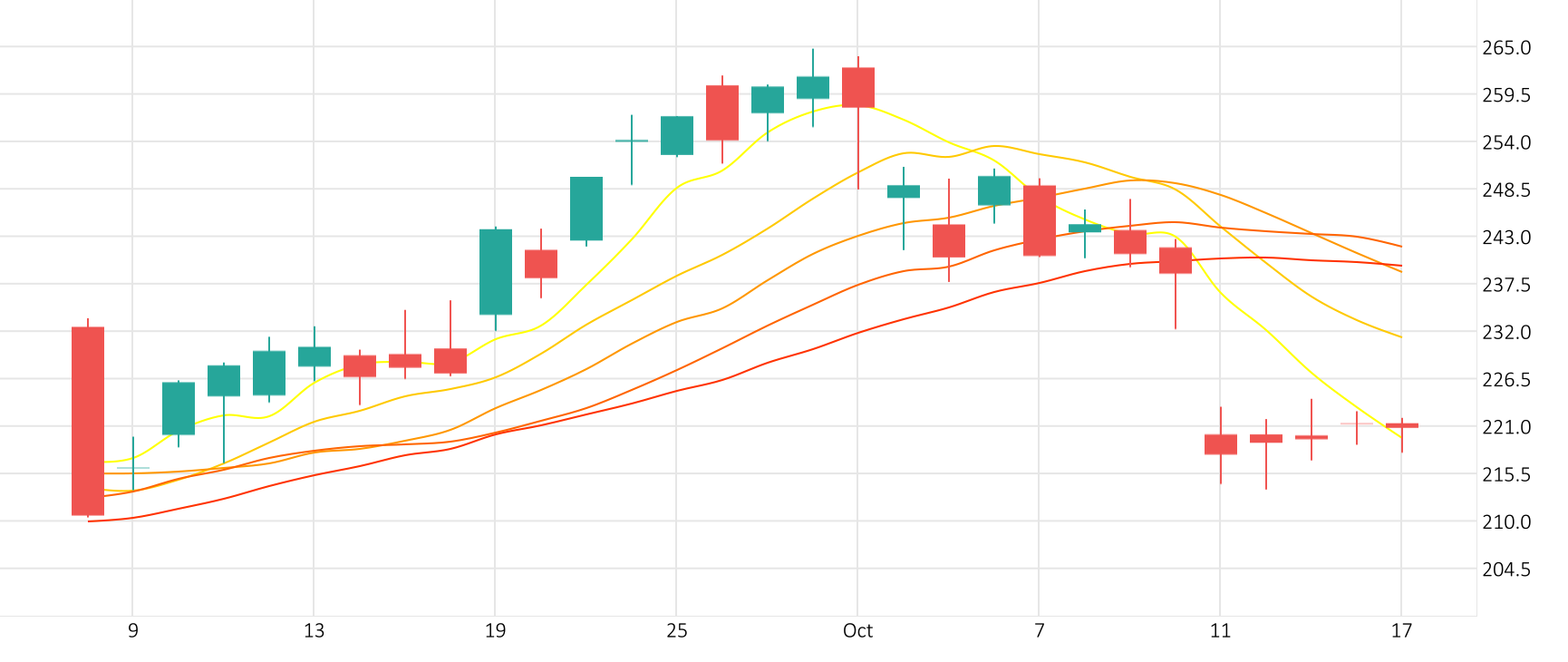

Elon Musk stands to benefit greatly from his ties with U.S. President-elect Donald Trump after the Tesla CEO became one of Trump’s most important supporters during the 2024 campaign. Tesla shares jumped 14% on Wednesday after Trump defeated Vice President Kamala Harri.