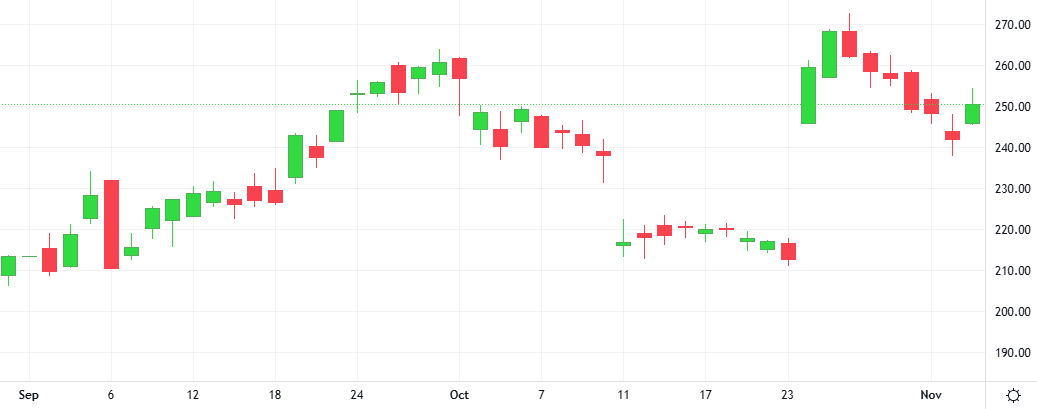

U.S. stocks soared to record highs after Republican Donald Trump won the 2024 U.S. presidential election in a stunning comeback four years after he was voted out of the White House. The Dow Industrials, S&P 500 and Nasdaq Composite all hit record highs.

U.S. President-elect Donald Trump’s impending return to the White House appears to put the Federal Reserve on a slower and shallower path for interest rate cuts, with a slew of new policies embraced by the Republican leader poised to juice the economy and stall, or reverse, the slowdown in inflation.