A Stock to Watch: Taiwan Semiconductor Manufacturing

By X-blogger - on May 28, 2024

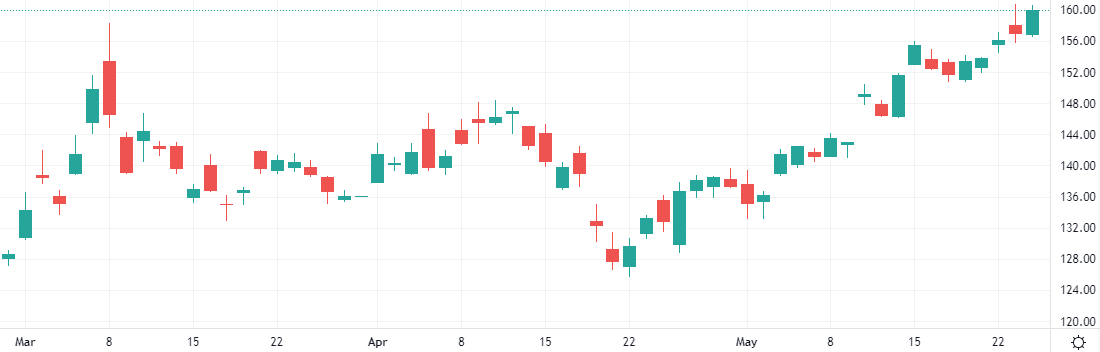

Taiwan Semiconductor Manufacturing (NYSE: TSM), a global leader in the semiconductor industry, saw its stock price rise by 1.9% last Friday to close at $160, driven by growing enthusiasm for artificial intelligence advancements.

Quarterly Earnings Report

On April 18th, TSMC announced an impressive performance for the first quarter of 2024, with a significant 8.9% year-on-year increase in net profit. The company reported a net profit of NT$225.49 billion (US$6.96 billion) for Q1, bolstered by its highest-ever first-quarter sales of NT$592.64 billion, a 16.5% increase from the previous year.

TSMC’s robust results are attributed to strong demand for its advanced semiconductor processes, essential for emerging technologies such as artificial intelligence and high-performance computing (HPC). This demand has effectively mitigated the downturn in the global smartphone market.

Advanced Process Technology

TSMC’s cutting-edge technology continues to lead the market, with its 3nm process accounting for 9% of Q1 sales, the 5nm process making up 37%, and the 7nm process representing 19%. These advanced processes contributed to 65% of TSMC’s total sales in the first quarter.

Looking Ahead

As TSMC continues to innovate, it is also preparing to launch its 2nm process in 2025, further cementing its position at the forefront of semiconductor manufacturing.

In summary, TSMC’s strong financial performance and ongoing advancements in semiconductor technology position the company well for future growth, despite facing some sector-specific challenges.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification