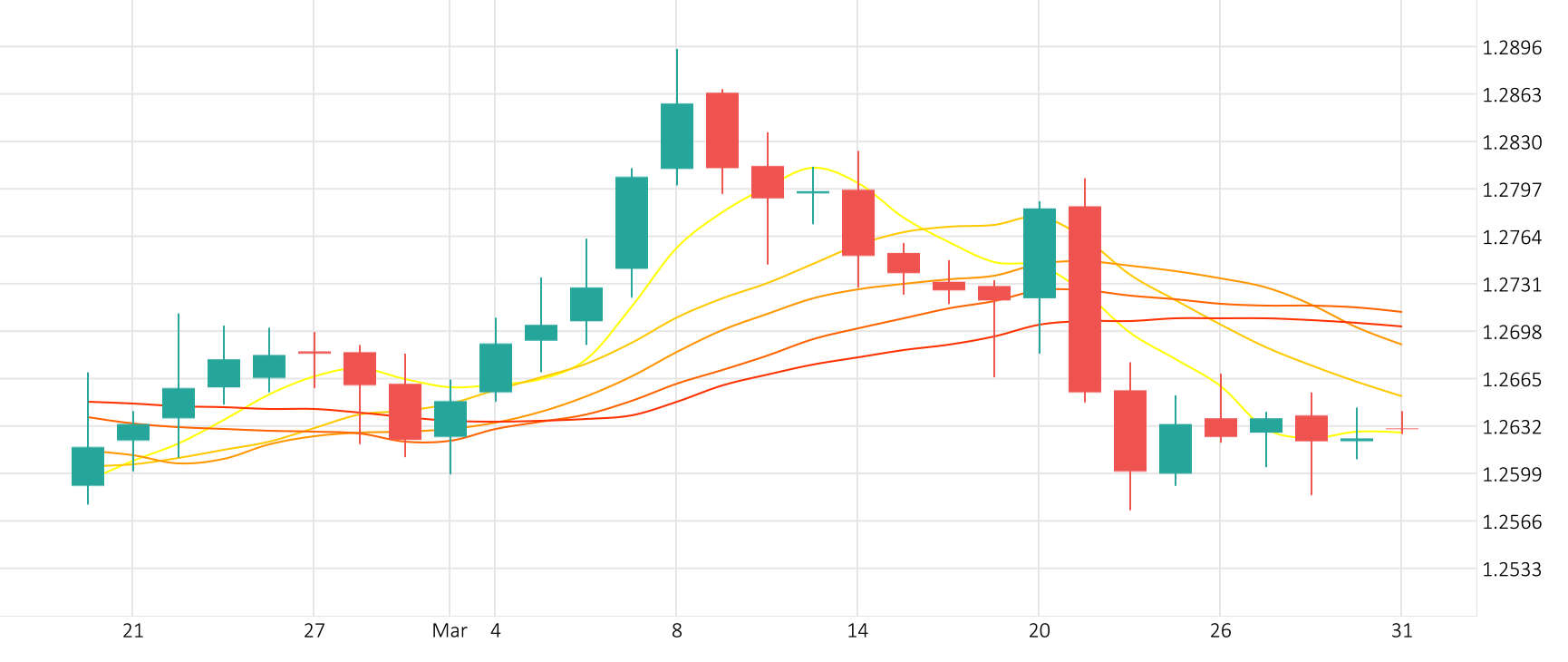

The Pound-Dollar pair traded sideways in the last session. The CCI is giving a positive signal.

GBP/USD remained largely unchanged in the last session.

The CCI is currently in positive territory.

Resistance 1.2697 Support 1.2589

The Pound-Dollar pair traded sideways in the last session. The CCI is giving a positive signal.

GBP/USD remained largely unchanged in the last session.

The CCI is currently in positive territory.

Resistance 1.2697 Support 1.2589

The Aussie-Dollar pair traded sideways in the last session. According to the Stochastic-RSI, we are in an overbought market.

AUD/USD remained largely unchanged in the last session.

The Stochastic-RSI is signalling an overbought market.

Resistance 0.6618 Support 0.6554

The Euro-Dollar price remained largely unchanged in the last session. The Ultimate Oscillator is giving a positive signal.

EUR/USD traded sideways in the last session.

The Ultimate Oscillator is currently in positive territory.

Resistance 1.0882 Support 1.0801

Alibaba shares saw a minor rise of 0.3% in the last session. The Williams indicator is giving a positive signal, going against our overall technical analysis.

Alibaba shares saw a minor rise of 0.3% in the last session.

The Williams indicator is giving a positive signal.

Resistance 72.395 Support 70.885

The Euro-Dollar price remained largely unchanged in the last session. The Stochastic-RSI indicates an oversold market.

EUR/USD traded sideways in the last session.

The Stochastic-RSI is signalling an oversold market.

Resistance 1.0827 Support 1.0772

The Pound-Dollar price remained largely unchanged in the last session. The ROC is giving a positive signal.

GBP/USD remained largely unchanged in the last session.

The ROC is currently in positive territory.

Resistance 1.2662 Support 1.2607